Steve Purvis , Managing Director – Warehousing

In the wake of the Coronavirus crisis, logistics professionals will be seeking to create supply chains that are far more flexible and resilient. Inevitably, a re-think on how much inventory is deployed across the network will be a major factor in reducing risk and securing supply. A new, intelligent strategy on managing space could hold the answer?

COVID-19, the associated lock-downs, and the double hit to both supply and demand, has challenged supply chains and distribution networks in ways unprecedented in the history of advanced economies. Some have stepped up to the plate in remarkable style, others are scrabbling to find workable solutions, and some of course have simply collapsed.

Challenges have extended across all supply chain activities, from sourcing, through transport and distribution, to the adoption of safe working practices. A common factor for many supply chains has been radical change in retailers’, manufacturers’ and shippers’ requirements for warehousing and warehouse-related activities. In some cases sales activity has slowed to a standstill and firms need somewhere, anywhere, to de-stuff containers and store goods that are still coming in from suppliers. In other sectors, health and groceries most obviously, demand has soared. However, the need to maintain safe distances while increasing throughput raises the floor-space requirement even further.

ECommerce and home delivery, to which much retail activity is moving, is notoriously hungry for warehousing/distribution centre space. Manufacturers too have backlogs, not only of finished goods that retailers cannot currently take, but also of raw materials, intermediate and part-finished goods that are waiting on disrupted supply lines.

According to a report just published by property consultants, JLL, entitled ‘COVID-19: Global Real Estate Implications’, the disruption to global supply chains will significantly impact the industrial and logistics property sector worldwide. The report notes the ‘outbreak is likely to elevate the issue of supply chain risk mitigation and resilience’, making it likely businesses will start re-shoring or near sourcing, as well as diversifying sourcing, resulting in additional regional demand for industrial facilities.

The report also points out that there could be a reversal of thinking on running lean supply chains with low inventory cover, leading to businesses deciding to increase their inventory levels in the long term – all of which would increase demand for warehousing space.

Clearly, businesses will need to look carefully at how they adapt their supply chains for a new reality post COVID-19, and importantly, how they flex their warehouse space requirements to build in resilience. But before reviewing forward strategies, what have businesses been faced with, here and now?

Enquiries to Visku in April 2020 give a flavour. We have seen manufacturers of, for example, flat pack furniture and kitchen units needing storage because, as no one is moving house or refitting their kitchen at this time. We have been asked to find space to support the spike in healthcare demand. Some requirements are more esoteric – storage of goods intended for a fast food chain’s cancelled promotion, and for goods supporting a major sporting event that has now been postponed to next year.

There are businesses that need space to which they can ‘pull back’ non-essential lines to concentrate on more important products. With much construction work stalled, there is expensive kit that needs to be kept somewhere secure. A trend that may yet be seen is the opportunistic buying of ‘fire sale’ goods in the current depressed markets – these materials and goods will also need to be stored. Some needs are fleeting – one business urgently required temperature-controlled storage, as in the early days of lock-down their usual site was not accepting ‘foreign’ drivers. Other requirements may extend for a year or more, even if lock-down is lifted quite soon.

The nature of the facility required also varies. Some just require deep, dark storage. Others need working space for break-bulk, repackaging, order picking with perhaps significant requirements for labour and IT support as well as space. Others again have minimal floor space requirements – they just need to increase their cross-docking capability. And of course some need reefer or environmentally controlled facilities, or high security, even bonded, warehousing.

Many businesses are navigating their way through the crisis by throwing extra assets, and cash, at the problem – extra staff, additional vehicles, but also for expensive warehouse space in a seller’s market. It’s worth noting that warehouse estate is attracting premium money from investors, and the UK is reckoned, by Savills and other agents, to be ‘under-warehoused’ even in normal times.

For many, this extra expenditure is unsustainable except in the shortest of terms. Tesco, for example, estimates its cost base has risen by between £650 million and £925 million on an annualised basis. Sales admittedly have soared, but on the lowest margin, basic, groceries. Tesco had the advantage of being able to bring back on line two significant facilities that it had been in the process of selling: other firms are not so blessed.

Amid the frenzied acquisition of warehouse space, it is hard to discern much implementation of deep, pre-existing, strategy. And that is strange as, although the combination of depth, reach and scale of the COVID-19 impact is certainly unprecedented, supply chain shocks are very common.

COVID-19 counts as a natural disaster, but there are others – regionally, many supply chains have not fully recovered from February’s floods. Weather ‘events’ in far-away places – floods in Bangladesh, typhoons in the Philippines – are an accepted hazard for the apparel industry. Globally, the effects of the Japanese tsunami of 2011 on sectors from automotive to electronics are well remembered. And it can seem that ‘100 year events’ now happen every month.

Other circumstances that impact on warehousing requirements have a more human element. ‘Preparation for Brexit’ has become a regular event, rather than the one-off that most businesses anticipated. There are planned events – for example stockpiling in advance of moving or re-equipping a production site, or against a major sporting event, or to support a new product launch. More generally, many companies see predictable activity peaks in the run up to Christmas, Easter, or the summer – weather permitting.

There is also the Black Friday phenomenon. The whole sales and promotions scene is out of kilter – back in the day, these were either to launch a new product into, it was hoped, a successful future, or to clear stocks of the less successful lines, not the almost continuous drive for turnover at the expense of margin.

In the process retailers, and more remotely their manufacturers, have lost an important tool. Sales and promotions could be used judiciously to manage demand, promoting turnover in slack times or on slow-moving lines, and conversely to spread peaks that otherwise would exceed the capacity to supply and so result in lost sales.

Yet in a time when almost every industry, rightly or wrongly, claims to be a lean, ‘Just in Time’ operator, many businesses seem deliberately to exacerbate the peaks and troughs. To work, JIT requires either a steady state, or at least accurate demand forecasting with a high degree of confidence. And so, however lean or JIT a business is at point of production, across the supply chain, buffer stocks are back.

Inevitably, post COVID-19 businesses will be looking to build far greater resilience into their supply chains. This will call for greater flexibility, enhanced agility and most likely, higher levels of inventory in the network.

But how should this stock be managed? Is there a cleverer way of flexing storage capacity with demand, improving efficiency and customer service, while keeping costs to a minimum?

Clearly, going forward, companies need an intelligent strategy for their warehousing requirements. They know there will be peaks and troughs in activity, although they may vary in the confidence with which they can predict either timing or scale. They also know that to use their own assets to fully provision against short-term peak demand would be hugely expensive.

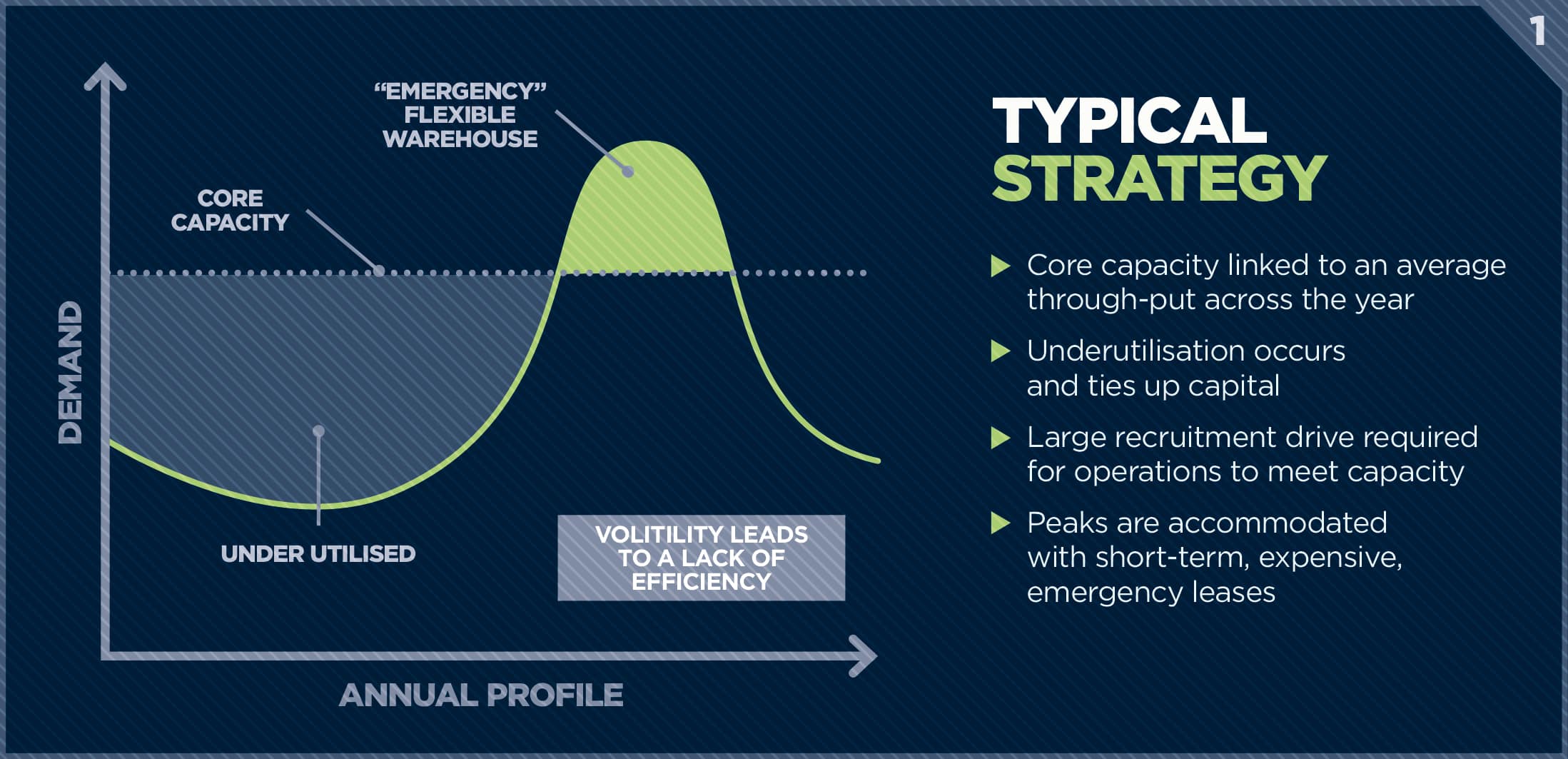

Typical Strategy

So the typical ‘strategy’ is to identify a ‘core capacity’, probably linked in some way to average throughput over the year. That will be served from the business’ own assets or through long-term contracts with 3PLs and might account for 90% or 95% of annual activity. Peaks that exceed that capacity are accommodated by short-term leasing of ‘emergency’ warehousing on a spot market.

On the face of it, that may sound like a reasonable strategy. But there are several problems. Firstly, emergency warehousing of that nature does not come cheap. Short leases are expensive, if the peak is for an event like Black Friday or Christmas there will be many other companies looking for space and driving prices up – and available space may not be in an ideal location for efficient transport and distribution.

Additionally, and depending on the profile of the various peaks and troughs and how they overlap, that ‘core capacity’ may spend much of the year seriously underused. That not only represents capital unnecessarily tied up, but may also lead to considerable effort in engaging extra warehouse staff at peak to bring operations up to capacity – before then bringing in the emergency facility as well.

It is also worth bearing in mind that offloading the problem onto a 3PL may not solve the issue. The 3PL has quoted for your business on the basis of clear predictions of volumes and timings. If that suggests, for example, that there is a three-month period where ‘your’ distribution centre is half empty, the 3PL will almost certainly have offered that capacity elsewhere. If an unanticipated ‘emergency’ arises the 3PL may not be able to oblige at a reasonable price, or at all. This may not be the 3PL being difficult – it’s how they control costs and leverage their assets.

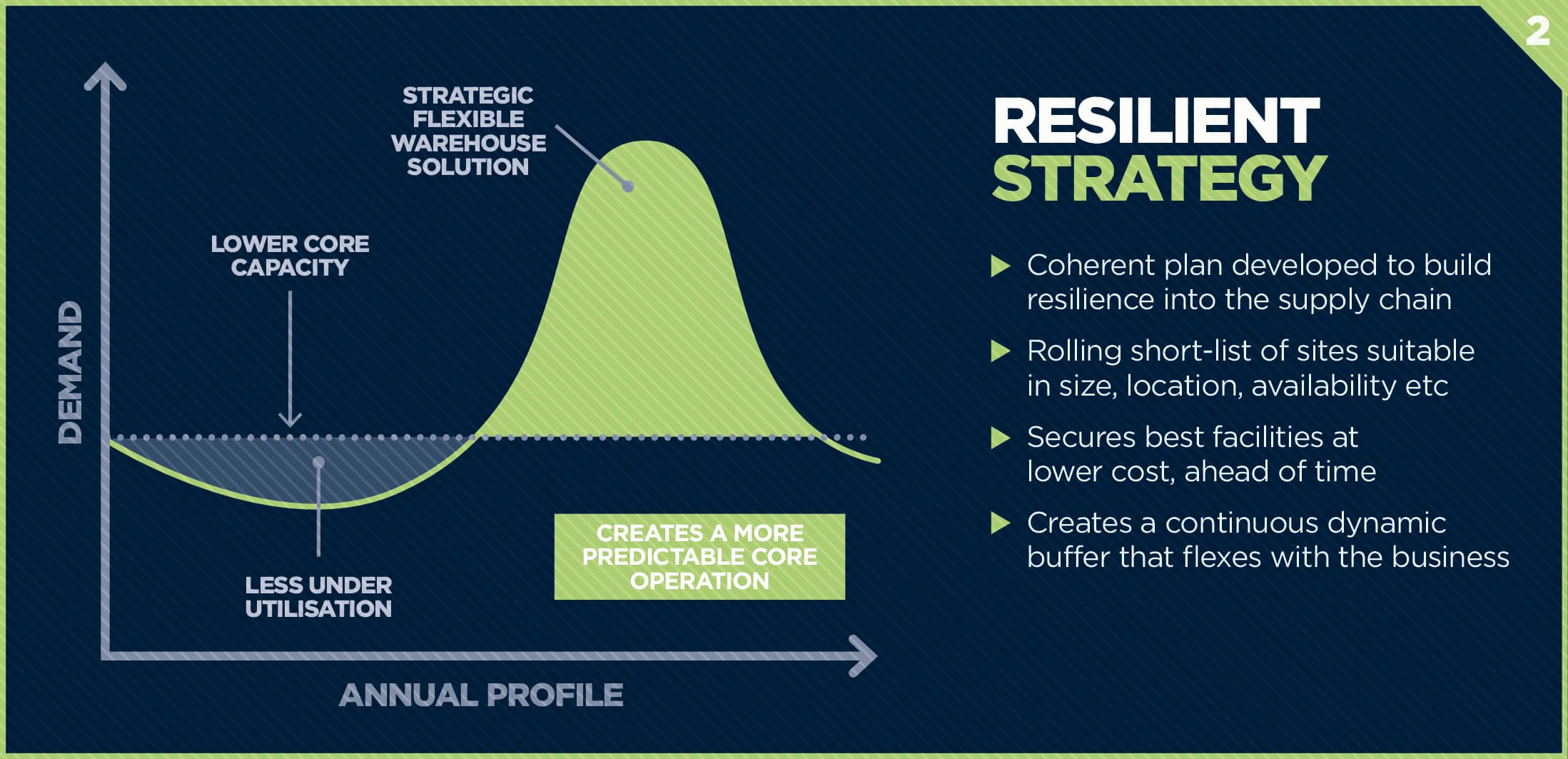

Resilient Strategy

However, there is an alternative strategy. That is to significantly lower the ‘core capacity’ of in-house or 3PL warehousing, and accept that coping with peaks, whether predicted or not, is far from an ‘emergency’ but a normal way of operating. This approach requires access to a range of sites, suitable in terms of size, location, duration of availability, access to labour, IT and other facilities. By tapping into the network of resources available through an independent space broker, and by working with them on a long-term partnership basis, a coherent plan can be developed that builds resilience into the supply chain. Importantly, the relationship needs to be year-round, not ‘just for Christmas’.

As situations develop, forecasts firm up and requirements crystallise, a rolling shortlist of possible solutions can be maintained. Likely sites can be inspected in advance and assessed to ensure that robust processes and continuity are assured – if we use this facility does that require a change in working practices, or in our distribution network, or our IT? Continuous assessment and analysis can enable the early securing of the best facilities at a reasonable cost – far preferable to those available under an emergency spot transaction. And because all this is planned, business can be switched in and out of the additional facilities seamlessly, with minimal impact on the costs and efficiencies of the supply chain and the customers it serves.

COVID-19 is certainly unprecedented in scale, but the problems in supply chain inventory and storage that it is exposing are pre-existing and, not uncommon. The world is increasingly uncertain, and our ability to manipulate supply and demand to our convenience is much diminished.

For many, ‘core’ or ‘steady state’ inventory is a decreasing proportion of the whole: much more is falling into the unpredictable, higher risk segment and that has a big impact on warehousing strategy.

Businesses that win out will take a strategic approach to utilising flexible storage space on a planned, on-going and coordinated basis, creating a continuous dynamic buffer that flexes with the business. They will work with a specialist space broker/facilitator, not to locate a shed at the last minute, but to analyse the supply chain, the inventory requirements and characteristics, as well as the resulting warehousing needs and solutions.

Contributors

Receive the latest news, insights and research papers from Visku

Required fields *

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.